Property investments have many advantages. From the likely value increase as house prices increase to the steady equity gain of paying off the debt via rental income. Focusing on acquiring property and renting it out is a popular choice for investors across New Zealand.

So why is investing in property an especially good idea in Taranaki? And more importantly why is 2020 an important year to invest? According to the Taranaki Property Investors Association’s annual rent movements are the highest in 11 years.

“High rental price increases should not come as a shock to anyone”, says Andrew King, Executive Officer of the NZ Property Investors’ Federation (NZPIF). “While Statistics NZ has pointed to the Healthy Homes legislation, this is only one change that has pushed rental prices higher.”

And whereas rental income growth has increased across the country there are several areas across Taranaki where savvy investors are seeing better returns than others. In this article, we’ll explore some of the hotspots in the region for rental growth.

With an increase in weekly rental payments, as well as the demand for rentals constantly on the increase, now is the time to get the most out of a rental property. Yet many in the region focus on New Plymouth as the nest to place their investment eggs. Whether you’re taking your first step on the investment ladder or looking to add more properties to your portfolio, there are a couple of reasons why now is a great time to look at new locations for your investments.

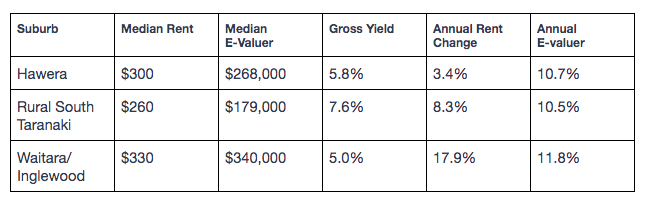

According to Real Estate Investar, Taranaki region has a population of 109,583 and 29.31% of its occupants live in rental accommodation. So, where is a good township to invest in Taranaki? According to QV’s latest statistics, rural South Taranaki’s annual rent change has increased by 8%. With the median weekly rent sitting at $260 per week with a median e-valuer of $179,000, the gross yield is sitting at the regions highest of 7.6%.

Waitara and Inglewood are also seeing great growth in rental returns while Hawera’s gross yield of close to 6% makes it one of the best townships for returning a good return on your investment. QV further breaks down the growth within the region and it makes for some quite interesting reading.

Source: QV

The added advantage of focusing on these locations is the relatively low house prices, which means newcomers to property investing, and those looking to add to their portfolio can achieve their goals without breaking the bank.

Whereas the average house price in New Plymouth is $481,139 (up 6.1% on last year) the average house price in South Taranaki is $256,035 (an increase of 13.2%) and in Stratford, it’s $307,305 (up by 19.8%).

For those investors concerned about the work that might be required to bring these homes up to the new Healthy Homes standard you needn’t worry as your McDonald Real Estate property manager will help tee you up with local contractors at competitive rates to ensure the work if needed, is completed.

As McDonald Real Estate has property managers all around the mountain you can invest in almost any town, regardless of how far and know that there’s a local specialist on hand to deal with your investment property needs. You no longer have to look at the affordable prices and excellent returns in a town over an hour’s drive away and wish it were closer so you could manage it – now you can have the best of both worlds.

To look at properties available in the growing areas of this region have a look at our residential sales page and have an expert property manager discuss your returns and management needs by clicking the button below.